Many pundits have been talking about the “green roots” of recovery. They proudly proclaim, “The bear market and Recession is over.” Not so fast, Bozo. Take a peak at the eye popping chart below. The Mortgage Reset market takes a break through 2009 and starts up in earnest in 2010 and 2011. As long term interest rates rise (due to the expectation of inflation), the housing problem is not over. If anything, they are only deferred.

GNMA (the Government owned Mortgage Company) is now making loans to home owners equal to 110% of the appraised value of the home, with subsidized interest rates. This got us into trouble to begin with. Robert Campbell the respected housing analyst, in his “Campbell Real Estate Timing Letter” writes:

“…there are strong similarities between Japan and the US. In Japan, driven by years of easy credit the Japanese stock and housing markets became a bubble. The bubble burst in 1990. One of the first lessons learned—or relearned, actually—is that when asset bubbles burst, there is nothing you can do to re-inflate them. But that’s what every Government US plan is still trying to do—keep housing prices from falling. In doing so, all we are doing is wasting trillions and trillions of dollars and digging ourselves into a deeper financial hole. Another lesson learned from the Japanese experience is that plunging asset prices do not result in a typical recession. The recessions are worse—sometimes far worse.”

“There is no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic laws on the side of destruction, and it does it in a manner which not one man in a million is able to diagnose.” John Maynard Keynes, 1919.

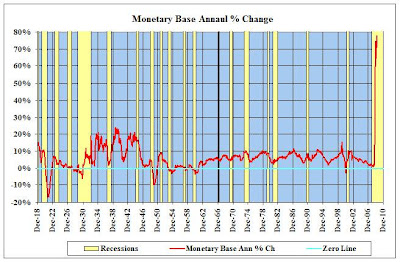

The printing of money that has just taken place in the past 18 months is mind boggling. Below is a chart of the Monetary Base. This is the basis for all money and debt creation. The Monetary Base is composed of two factors, namely, Currency In Circulation and Bank Reserves. When the Monetary Base goes up, it triggers inflation. When it goes up 77% in one year, God help us.

The decline in the Monetary Base from February 1921 to September 1922 was facilitated by oversupply of goods and a decrease in demand, following World War I. The massive 1921 recession was followed by a rapid recovery. The Keynesian economic philosophy ignored this recession because it suggests that government intervention is not required in such cases. Free markets adjust prices and supplies much more efficiently than any government coordinated action. This should have been the model for the great depression and the current boondoggle. Instead we repeat the errors of the past—massive Government spending, trade protectionism, and intervention in the free markets.

The expansion of debt is the driver of inflation. If a residential unit could not be acquired without financing, the price of a new home would probably be less than $50,000. Bubbles in assets are a result of too much money and credit chasing a given supply of assets. The next bubble? Gold and Commodities.

The massive expansion of US Debt can only lead to a crowding out of private capital and - at the same time trigger declining bond prices and an increase in interest rates. The only way to reduce this expansion of debt is Government Surpluses in the future (not likely given Obama, Pelosi, and Frank at the helm), or increase US output significantly (not likely to happen in the short run).

The renowned Economist, John P Hussman (www.hussmanfunds.com) writes, “The price level is essentially the ratio of two marginal utilities – the marginal utility of goods and services divided by the marginal utility of government liabilities.” (“Marginal” in economic terms means the increase or decrease of utility, and “utility” means the satisfaction level of an economic decision.) Hussman continues, “We have seen no inflation in response to the huge issuance of Treasury securities because presently the marginal utility of goods and services is depressed (because people are still in the process of shifting away from credit financed consumption), while the marginal utility of government liabilities is still elevated (because people are still averse to holding savings in the form of more risky asset). Unless the current, unusual profile of marginal utilities persists indefinitely, we can expect that a normalization of the relative utilities of goods and services to government liabilities will result in a large upward ship in the US price level.”

John Taylor, and economics professor at Stanford University wrote in the Financial Times (May 2009), “To bring the debt-to GDP ratio down to the same level as at the end of 2008 would take a doubling in prices. That 100 percent increase would make nominal GDP twice as high, and thus cut the debt to GDP ratio in half, back to 41 from 82%. A 100 percent increase in the price level means about 10 percent inflation for 10 years, but that would not be smooth – probably more like the great inflation of the late 1960’s and 1970’s with boom followed by bust and recession every three or four years, and a successively higher inflation rate after each recession.”

Over the next ten years, inflation is a lock. In the short run (next 18 months) the deflationary trend will continue. The banking system is now experiencing problems in rising delinquency rates of credit card debt, commercial loans, and real-estate loans. The consumer will continue to payoff debt, cut spending, and attempt to save.

The best investment you can make today is: get out of debt, have some cash savings and take a position in Gold.

I hate to be the bearer of bad news. I would like to report that the Economy is about to rebound, and the Equity Market will experience the biggest bull market in history. Problem is, I don’t believe it.

On a lighter note, my Granddaughter hit in the winning run for the Aliso Viejo softball girl’s championship game.

The expansion of debt is the driver of inflation. If a residential unit could not be acquired without financing, the price of a new home would probably be less than $50,000. Bubbles in assets are a result of too much money and credit chasing a given supply of assets. The next bubble? Gold and Commodities.

The massive expansion of US Debt can only lead to a crowding out of private capital and - at the same time trigger declining bond prices and an increase in interest rates. The only way to reduce this expansion of debt is Government Surpluses in the future (not likely given Obama, Pelosi, and Frank at the helm), or increase US output significantly (not likely to happen in the short run).

The renowned Economist, John P Hussman (www.hussmanfunds.com) writes, “The price level is essentially the ratio of two marginal utilities – the marginal utility of goods and services divided by the marginal utility of government liabilities.” (“Marginal” in economic terms means the increase or decrease of utility, and “utility” means the satisfaction level of an economic decision.) Hussman continues, “We have seen no inflation in response to the huge issuance of Treasury securities because presently the marginal utility of goods and services is depressed (because people are still in the process of shifting away from credit financed consumption), while the marginal utility of government liabilities is still elevated (because people are still averse to holding savings in the form of more risky asset). Unless the current, unusual profile of marginal utilities persists indefinitely, we can expect that a normalization of the relative utilities of goods and services to government liabilities will result in a large upward ship in the US price level.”

John Taylor, and economics professor at Stanford University wrote in the Financial Times (May 2009), “To bring the debt-to GDP ratio down to the same level as at the end of 2008 would take a doubling in prices. That 100 percent increase would make nominal GDP twice as high, and thus cut the debt to GDP ratio in half, back to 41 from 82%. A 100 percent increase in the price level means about 10 percent inflation for 10 years, but that would not be smooth – probably more like the great inflation of the late 1960’s and 1970’s with boom followed by bust and recession every three or four years, and a successively higher inflation rate after each recession.”

Over the next ten years, inflation is a lock. In the short run (next 18 months) the deflationary trend will continue. The banking system is now experiencing problems in rising delinquency rates of credit card debt, commercial loans, and real-estate loans. The consumer will continue to payoff debt, cut spending, and attempt to save.

The best investment you can make today is: get out of debt, have some cash savings and take a position in Gold.

I hate to be the bearer of bad news. I would like to report that the Economy is about to rebound, and the Equity Market will experience the biggest bull market in history. Problem is, I don’t believe it.

On a lighter note, my Granddaughter hit in the winning run for the Aliso Viejo softball girl’s championship game.