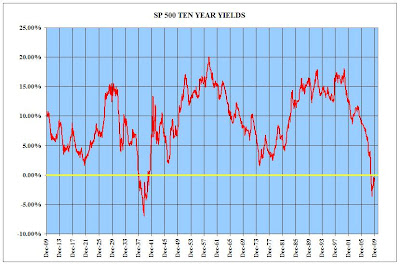

Factoring in the inflation rate (as measured by the Consumer Price Index) it was even worse, with a negative yield for the 10 years Ended December 2008 and 2009 of -4.09% and -3.45%. So much for the buy and hold theory.

The Table below shows various percent changes for the 10 years ended 12/31/08 and 12/31/09 and the related nominal annual yields compounded monthly. The Gross National Product grew at 4.64% and 4.29% respectively. The Inflation rate as measured by the Consumer Price Index was 2.53% and 2.57%. Commodity investments provided a 1.83% and 5.25% yield. Gold (the best of the best) yielded 10.48% and 13.85%. New homes (based on price only, assuming no carrying costs) yielded 4.10% and 2.97% while the US dollar collapsed, declining 16.76% and 27.50% for the 10 years.

Even high quality stocks such as Cisco Systems, Coca-Cola, Microsoft, General Electric and Bank of America provided negative yields for 10 years. It is highly unusual for any ten year period to provide negative yields in common stocks. What’s going on?

The Federal Reserve policy of low interest rates and easy money has fueled the “era of the bubbles.” The creation of retirement plans many years ago created a new demand for stocks. Mutual funds started popping up that were more than willing to handle Employee Retirement Plans. Then for an encore, Exchange Traded Funds (ETF’s) were created to give investors access to any type of investment desired. Today there are quotes from Mutual Funds, and ETF’s that fill 3 pages of the daily newpapers. Today the average investor can invest in Brazilian Reals, Platinum, Gold, Natural Gas and Oil – all through Mutual Funds or ETF’s. It’s no wonder that America does not produce anything any more. The United States has become a service economy.

There are too many Mutual Funds, and ETF’s, all competing for investor dollars. Their only business is to own stocks, bonds, and real estate, regardless of whether such investment medium is reasonably priced. In fact I submit the continuous buying has created bloated stock values.

The current high priced stock market is just another bubble. The bubble is fueled by low interest rates, complacency, and easy money. The stock market wins by default because there are no other alternatives. Where do you put your money? Real Estate, Commodities, Gold, Debt instruments? In my opinion the stock market is overvalued and will decline materially from current levels.

Dr. John Hussman (hussmanfunds.com) referring to the current stock market notes that “Most of what we are seeing now is a tendency to make marginal new highs, back off slightly, and then recover that ground enough to register another marginal new high. As I’ve noted frequently, when market conditions are characterized by unfavorable valuations, overbought conditions, over bullish sentiment, and upward yield pressures, the market’s tendency is exactly that – to make continued marginal new highs for some period of time, followed by abrupt and often steep losses virtually out of nowhere.”

Personal Consumption as a percent of GDP is about 68% to 70%. For the Economy to improve, you need the Consumer to spend money. If he’s unemployed and his asset base has been depleted, it’s impossible for that to happen. As a result GDP drops. As GDP drops, so does the stock market. Over the next few years, GDP will not grow at the levels of the past. Pimco (an investment manager) has termed this slower GDP growth as the “new norm”.

The consumer is in the process of de-leveraging and saving, not spending. This process of de-leveraging is deflationary. Our politicians and leaders have printed money and added substantially to Public Debt which is inflationary. For inflation to really get going, the consumer must spend money. While we wait for the consumer to get out of debt and save his money we get deflation.

So, in the short run, we get deflation (a correction of the price level which is not positive for most investments). As the Economy improves and the unemployment rate starts to drop, the money supply (which has been expanded exponentially) turns over faster (economists call this turnover of money “Velocity”.) As velocity goes up we get inflation.

US Public Debt is estimated to be over 100% of GDP by 2010/2011. This assumes that GDP will grow by 5% in 2011 and almost 6% in 2012. In my opinion, these assumptions are overly optimistic. The size of US Public Debt as a percent of GDP will probably be over 100% by 2011. The creditworthiness of the USA and its Reserve Currency status is at risk. The US Dollar is a currency that other countries can use as a reserve (saving). China, Brazil, Russia, India, and most other countries use the US Dollar as a reserve. This means, that US Dollars are hoarded, not sold. Should the US lose their Reserve status, dollars would be sold, US Dollar denominated Bonds would be sold, and interest rates would go through the roof, which would make it substantially harder for the US to finance their nonsense, and could well have the US Bonds rated “junk”. Needless, to say, the Stock Market would crash.

The US Economy is undergoing a major correction of excesses that have been building since the late 80’s. There are major cross-currents in today’s World Economy: Deflation/Inflation; credit standing of the USA and other developed countries; Public Debt etc. The US Dollar in a deflation, make sense, as long as it is still considered the “Reserve Currency”. Stocks will not do well in a deflation or inflation. Some Bonds will due well in a deflation (US Bonds) and Commodities and Real Estate should do well in an inflationary environment.

In the interim, stay liquid, get out of debt, and hold some Gold. The theme is survival!

1 comment:

Another great blog, Papi. Thank you for making it easy enough for a marketing guy like me to understand. Got the message! Thank you.

Post a Comment